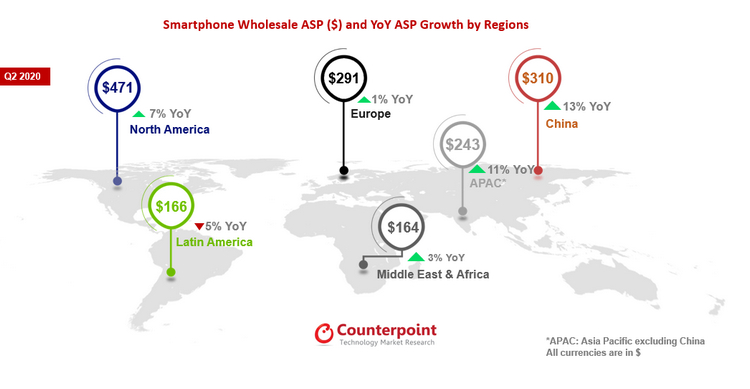

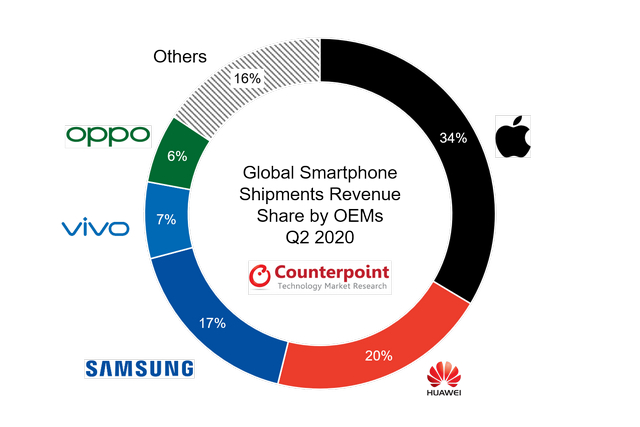

As per the report, the resilience of the premium segment was best illustrated by the demand for iPhones, with Apple said to have improved its market-share by 3% YoY even as shipments for most other OEMs declined significantly. “The economic impact of the pandemic on the potential user base of the premium segment was less when compared with other customer segments”, said Varun Mishra, a Research Analyst at Counterpoint. Image Courtesy: Counterpoint Research Meanwhile, one of the major factors that contributed to an uptick in the ASPs is the increasing adoption of 5G technology around the world. According to the report, 5G contributed to 10% of the total global handset shipments but contributed to 20% of the total handset revenue. China was the largest contributor to 5G sales, with around 72% of the global 5G handset revenue coming from the country. Image Courtesy: Counterpoint Research On the flip side, demand for affordable handsets declined dramatically because of low consumer sentiment among middle and working-class populations around the world. “Overall, the reduction in demand for lower price tier devices due to economic impact and offline retail closure, the resilience of the premium segment, and the uptick in 5G sales, especially in China, contributed to the rise of smartphone ASP during the quarter”, said the report.